Qbi Deduction 2025 - How to calculate a qualified business income deduction. QBI Deduction What It Is, Who Qualifies & How to Take It Hourly, Inc., The qbi deduction is available to most people. Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income minus capital gains.

How to calculate a qualified business income deduction.

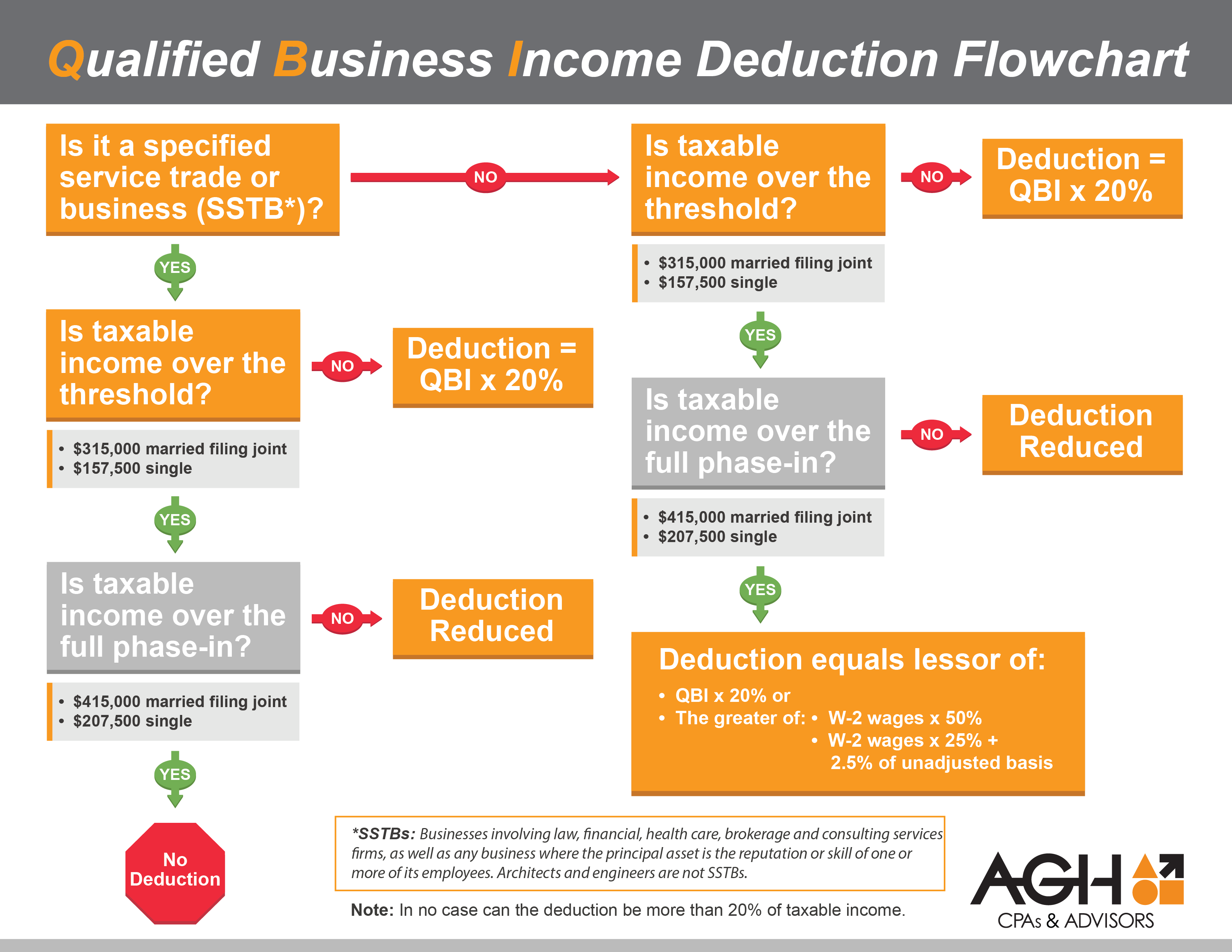

The threshold ranges from $160,700 to $210,700 for single filers and from $321,400 to $421,400 for married filing jointly.

What Is the QBI Tax Deduction and Who Can Claim It?, The qbi deduction is the lesser of (1) 20% of qbi or. Jul 15, 2025 • 4 min read.

Qbi Deduction 2025. For instance, if your monthly basic salary is rs. The qbi deduction is subject to several limitations and restrictions.

The qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. The threshold ranges from $160,700 to $210,700 for single filers and from $321,400 to $421,400 for married filing jointly.

Do I Qualify for the Qualified Business (QBI) Deduction? Alloy, After that, it’s scheduled to disappear, unless congress passes. Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income minus capital gains.

Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income minus capital gains.

QBI Deduction What It Is, Who Qualifies & How to Take It Hourly, Inc., Basically, the deduction allows taxpayers to deduct 20% of the qbi from qualified businesses owned by the taxpayer. “[this] allows eligible taxpayers to deduct 20% of qbi under specific.

What Is The Deduction For Qualified Business businesser, Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income minus capital gains. The threshold ranges from $160,700 to $210,700 for single filers and from $321,400 to $421,400 for married filing jointly.

After that, it’s scheduled to disappear, unless congress passes.

Jennifer Lopez Photos 2025. Ben affleck and jennifer lopez at the 81st golden globe awards […]